Banking Jobs in USA 2026: All Types of High-Paying Roles, Salaries, Cities & Hiring Trends (Updated December 2025)

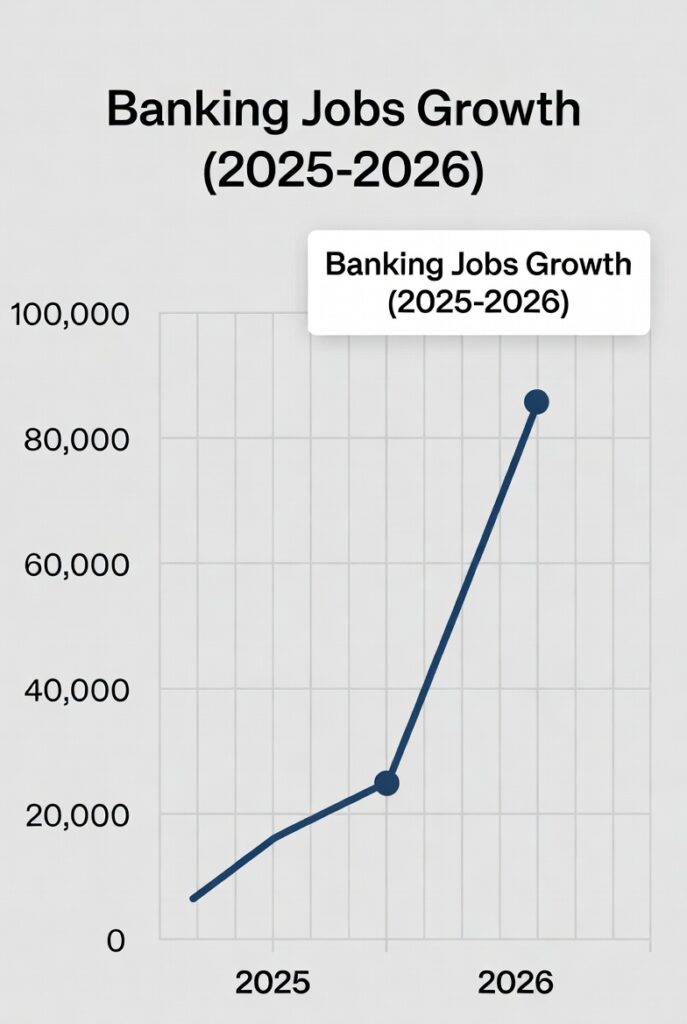

The U.S. banking industry is set for explosive growth with Banking Jobs in USA 2026, with the Bureau of Labor Statistics projecting over 942,500 annual openings in business and financial occupations — including a strong subset of 150,000+ banking-specific roles like analysts, tellers, and compliance officers. As interest rates stabilize and M&A activity surges, banking jobs in USA 2026 offer unmatched opportunities for entry-level to executive careers.

This comprehensive December 2025 guide covers all types of banking jobs in USA 2026: investment banking, commercial, retail, operations, risk, and more. Whether you’re eyeing six-figure salaries in New York or remote roles from anywhere, here’s everything you need to land your dream job. Already exploring how to make money online from home in 2025?

Why Banking Jobs in USA 2026 Are Booming Across All Types

2026 marks a pivotal year: Fed rates at 3.75–4.25% boost profits, private credit hits $2.5 trillion, and AI regulations create 30,000+ new compliance spots. Indeed’s 2026 Hiring Trends Report predicts stabilized but high-volume openings, with total employment in finance growing 5.2 million jobs through 2034.

Key drivers for all banking job types:

- Investment & Commercial Banking: M&A volume up 20% to $6 trillion.

- Retail & Teller Roles: Digital shift but 29,800 teller openings despite 13% decline.

- Operations & Risk: AI and RegTech demand skyrockets.

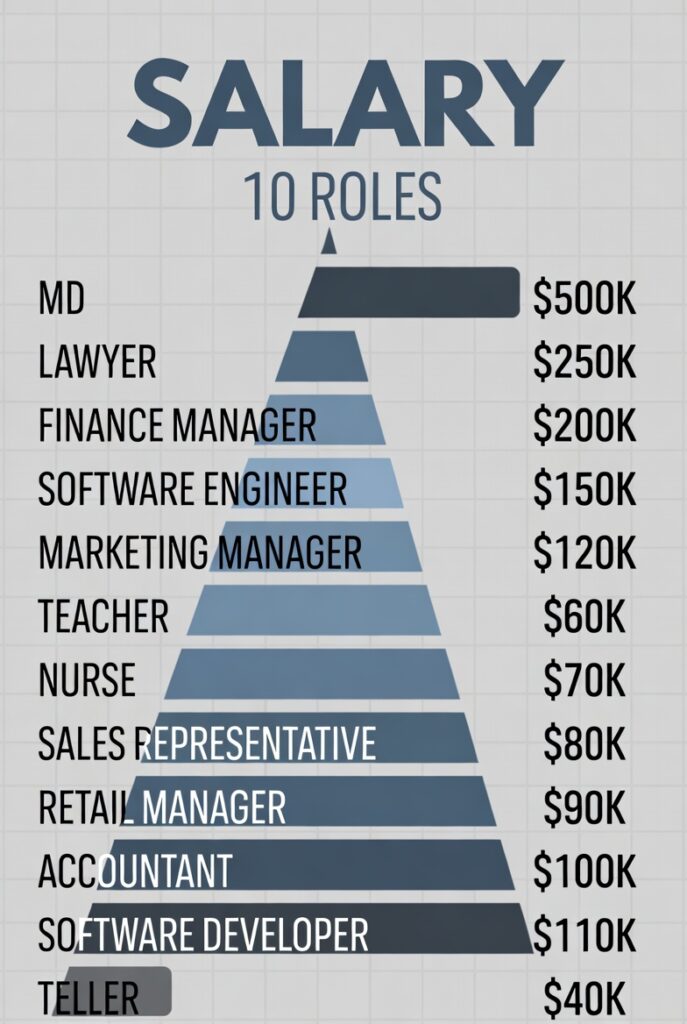

Average salary across all types: $85,000–$120,000, with top earners exceeding $500K.

Highest Paying Banking Jobs in USA 2026: Top Roles by Type (December 2025 Salaries)

From bulge-bracket analysts to regional risk managers, here’s a breakdown of highest paying banking jobs USA 2026 with real data from Robert Half’s 2026 Salary Guide and ZipRecruiter.

Investment Banking Jobs in USA 2026

- Managing Director: $350K–$600K base + $1.5M–$12M bonus (Goldman Sachs, JP Morgan).

- Vice President: $275K–$400K + $400K–$1M bonus.

- Analyst (Entry-Level): $110K–$150K total comp.

Commercial & Corporate Banking Jobs in USA 2026

- Relationship Manager: $150K–$250K + commissions.

- Credit Analyst: $80K–$130K.

Retail & Branch Banking Jobs 2026

- Branch Manager: $90K–$160K.

- Private Banking Analyst: $89K–$120K (top 10% at $150K+).

Operations, Risk & Compliance Banking Jobs 2026

- Risk Manager: $180K–$320K (highest demand per Times Pro 2026 report).

- Compliance Officer: $140K–$260K.

- AI Model Validator: $180K–$300K + 60% bonus.

(Data: BLS 2025, Robert Half 2026, Wall Street Oasis).

Best Cities for All Types of Banking Jobs in USA 2026

Location matters — here’s where banking jobs in USA 2026 cluster, per Forbes and SignalHire 2025 data (projected stable into 2026).

- New York City: 58% of investment roles; average salary $150K+.

- San Francisco: Fintech + traditional banking; $160K avg.

- Charlotte, NC: Commercial hub (Bank of America); $120K avg, low cost.

- Chicago: Trading & corporate; $140K.

- Miami: Hedge funds & PE boom; fastest growth.

- Dallas: Energy finance; $130K.

- Salt Lake City: Emerging tech-finance; high earning potential.

Entry-Level and Remote Banking Jobs in USA 2026: Easy Starts for Beginners

No experience? Entry-level banking jobs 2026 like tellers ($40K–$50K) or operations analysts ($60K–$80K) lead to promotions. Analyst programs at Deutsche Bank and Barclays open Jan–Feb 2026.

Remote banking jobs USA 2026 trend: 23,000+ openings on LinkedIn, per ZipRecruiter. Permanent WFH in:

“Want to add passive income on top of your banking job? Check these best passive income ideas for 2025”

- Loan Processing: $60K–$100K.

- Customer Service: $45K–$65K.

- Compliance & AML: $80K–$140K.

Top remote employers: Capital One, Ally, U.S. Bank.

Top Banks Hiring for All Banking Job Types in December 2025 (For 2026 Starts)

Over 15,000 roles live now, per Indeed and bank career sites.

- JPMorgan Chase: 5,000+ across investment/commercial.

- Bank of America: Charlotte expansion; retail/operations.

- Goldman Sachs: Analyst programs closing soon.

- Wells Fargo: Wealth & risk roles.

- Morgan Stanley: Investment focus.

- Citigroup: Global commercial.

- Barclays & Deutsche Bank: Tech/grad hires.

- Regional: PNC, Truist, Fifth Third.

Apply via careers.bankofamerica.com or careers.db.com.

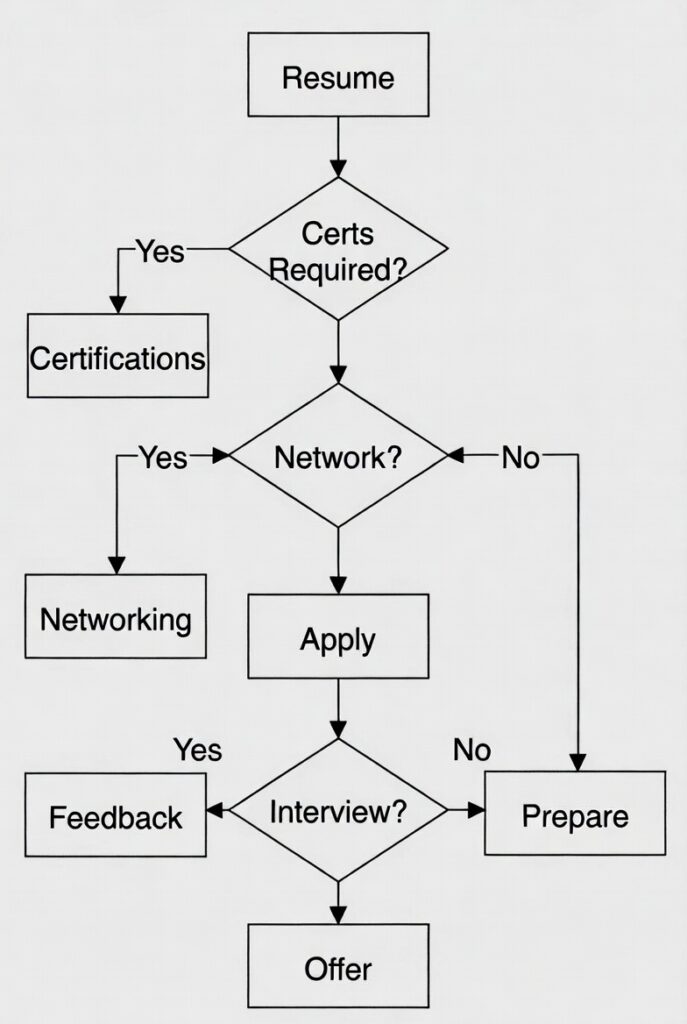

How to Land Banking Jobs in USA 2026: Step-by-Step Guide for All Types

- Tailor resume with keywords (e.g., “risk manager” for compliance roles).

- Certifications: Series 7/63 for investment; CFA Level 1 for analysts.

- Network: LinkedIn, Wall Street Oasis forums.

- Apply early — 2026 deadlines Jan 15 (investment) to rolling (retail).

Success story: Non-target grad lands $120K analyst role at Evercore (see our internal story below).

FAQ: Common Questions on Banking Jobs in USA 2026

Q: What are the highest paying banking jobs USA for beginners? A: Investment analyst ($110K+) or private banking roles ($89K avg).

Q: Are remote banking jobs USA 2026 growing? A: Yes — 3,000+ on Indeed, focused on operations/compliance.

Q: Which city has the best banking jobs in USA 2026 for families? A: Charlotte: High pay, low costs.

Previous Post:

Make Money Online by Bank Account

The 2026 banking boom is here — update your LinkedIn and apply today for all types of roles.

Which banking job type are you targeting? Comment below!

(Updated December 2025 — bookmark for yearly refresh!)