In 2026, building passive income through dividend stocks remains one of the smartest strategies for US investors seeking financial freedom. With interest rates stabilizing and markets rewarding reliable payers, the best dividend stocks for passive income USA 2026 offer consistent cash flow, dividend growth, and resilience against volatility. Whether you’re a beginner in California, a retiree in Florida, or anywhere in the USA, investing in top dividend-paying companies can generate thousands in annual income with minimal effort.

According to recent data from Morningstar and The Motley Fool, high-quality dividend stocks have outperformed in uncertain markets, providing both yield and capital appreciation. This guide highlights the best dividend stocks for passive income USA 2026, focusing on Dividend Aristocrats, monthly payers, and high-yield options safe for long-term holding.

Table of Contents

Why Choose the Best Dividend Stocks for Passive Income 2026?

Dividend stocks provide truly passive income—money deposited directly into your brokerage account without selling shares. In 2026, with inflation cooling but economic uncertainty lingering, these stocks offer:

- Reliable Cash Flow: Quarterly or monthly payouts for expenses or reinvestment.

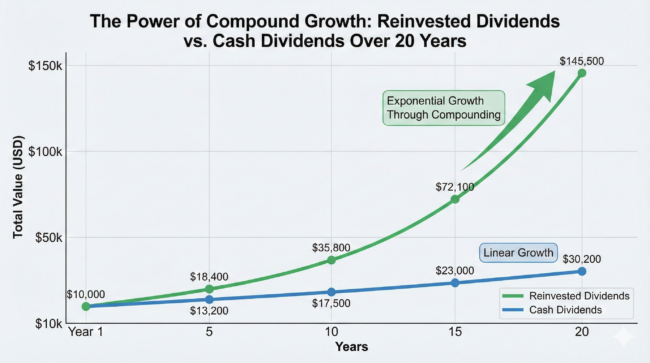

- Compound Growth: Reinvesting dividends supercharges returns over time.

- Inflation Protection: Many companies raise dividends annually, beating inflation.

- Lower Volatility: Dividend payers tend to be mature, stable businesses.

Start investing today with a commission-free platform like Robinhood.com

Top 10 Best Dividend Stocks for Passive Income USA 2026

Our selections for the best dividend stocks for passive income 2026 are based on yield, payout safety, dividend growth history, and analyst recommendations from sources like Morningstar, Seeking Alpha, and The Motley Fool (as of February 2026). We prioritize companies with strong balance sheets and consistent increases.

| Rank | Ticker | Company | Approx. Yield | Sector | Dividend Growth Streak | Why It’s Great for Passive Income |

|---|---|---|---|---|---|---|

| 1 | O | Realty Income | 5.2% | REIT | 31+ years | Monthly dividends, 98%+ occupancy, known as “The Monthly Dividend Company.” |

| 2 | EPD | Enterprise Products Partners | 6.5% | Energy Midstream | 25+ years | Ultra-safe pipeline assets, high yield with steady distributions. |

| 3 | VZ | Verizon | 6.0% | Telecom | 18+ years | Essential services, massive cash flow supports high yield. |

| 4 | KO | Coca-Cola | 3.0% | Consumer Staples | 63+ years | Dividend King with global brand strength and consistent raises. |

| 5 | DUK | Duke Energy | 4.0% | Utilities | 10+ years | Regulated utility with predictable revenue and growth. |

| 6 | BX | Blackstone | 3.7% | Financials | Growing | Asset management giant with strong payout growth. |

| 7 | ABBV | AbbVie | 3.2% | Healthcare | 10+ years (post-spin) | Blockbuster drugs drive high margins and dividends. |

| 8 | MDT | Medtronic | 2.8% | Healthcare | 48+ years | Medical device leader with reliable innovation. |

| 9 | PEP | PepsiCo | 3.5% | Consumer Staples | 50+ years | Diversified snacks/beverages for stable demand. |

| 10 | BIPC | Brookfield Infrastructure | 4.5% | Infrastructure | Growing | Essential assets like utilities and transport for inflation-protected income. |

Criteria for Selecting the Best Dividend Stocks for Passive Income USA 2026

We evaluated stocks based on payout ratio (<75% for safety), debt levels, free cash flow coverage, and economic moat. Focus on Dividend Aristocrats (25+ years of increases) and monthly payers for smoother income.

Best Monthly Dividend Stocks for Steady Passive Income

For truly passive cash flow, monthly payers like Realty Income (O) beat quarterly options. Other strong 2026 picks include Main Street Capital (MAIN) and EPR Properties (EPR).

How to Start Investing in Dividend Stocks

- Open a brokerage account (try Robinhood for free trades).

- Research via tools like Yahoo Finance or Seeking Alpha.

- Buy shares and enable DRIP (dividend reinvestment).

- Diversify across 10-20 stocks.

- Hold long-term for compounding.

Related Previous Posts & Stories

← Best AI Tools for Making Money Online in USA 2026

← Best Real Estate Investing Apps USA 2026

← Top Ways to Make Money from Surveys USA 2026

← Best Ways to Build Credit Score Fast in USA 2026

←Best Credit Cards for Rewards USA 2026

← Best Online Business Ideas USA 2026

←Best Investment Apps for Gold Silver Price Forecast 2026

External Resources

Frequently Asked Questions (FAQ)

What are the best dividend stocks for passive income 2026?

Top picks include Realty Income (monthly payer), Enterprise Products Partners (high yield), and Coca-Cola (reliable growth).

How much can I earn in passive income from dividend stocks?

With $100,000 invested at 5% average yield, expect ~$5,000/year (pre-tax), growing over time.

Are dividend stocks safe in 2026?

Focus on Aristocrats and low-payout companies for safety; diversify to reduce risk.

Should I choose monthly or quarterly dividend stocks?

Monthly for steady cash flow (ideal for retirees); quarterly often have stronger growth.

Is dividend income taxable in the USA?

Qualified dividends are taxed at lower capital gains rates (0-20%); hold in tax-advantaged accounts like IRAs for deferral.

Disclaimer

This article is for informational purposes only and is not financial advice. Stock values and dividends can decrease; past performance does not guarantee future results. Consult a financial advisor before investing. Affiliate links may earn us a commission at no extra cost to you. Data approximate as of February 2026; always verify current yields.