How to Reduce Credit Card Debt Fast USA 2026: A Guide for Reduce Debt

Are you overwhelmed by credit card debt in 2026? With average balances hovering around $6,500 and interest rates still high (often 20%+ APR), it’s no wonder many Americans are seeking quick relief. But the good news is, with strategic planning and disciplined action, you can slash your debt faster than you think. In this guide tailored for USA residents, we’ll cover proven methods to reduce credit card debt efficiently, including debt payoff strategies, balance transfers, and more. Whether you’re dealing with holiday overspending or long-term balances, these tips can help you achieve financial freedom by year’s end.

We’ll draw from expert advice from sources like NerdWallet and Experian, focusing on 2026 trends like stabilizing inflation and accessible debt relief options. Remember, the key is consistency—start today to see results tomorrow.

Why Credit Card Debt is a Big Issue in 2026 USA

Credit card debt hit record highs in 2025, and 2026 brings both challenges and opportunities. High APRs continue to compound balances, but with economic recovery, more Americans are qualifying for lower-rate options. Factors like inflation slowdowns mean budgets can stretch further, allowing aggressive debt repayment.

Common causes include unexpected expenses, job changes, or simply living beyond means. The average U.S. household carries multiple cards, making consolidation vital. Reducing debt not only saves on interest but also boosts your credit score, opening doors to better loans and financial stability.

Table of Contents

Step 1: Assess Your Current Debt Situation

Before diving in, get a clear picture:

- List all cards: Balances, APRs, minimum payments.

- Calculate total debt and monthly interest.

- Check your credit score (free via Credit Karma or AnnualCreditReport.com).

- Track spending: Use apps like Mint or YNAB to identify leaks.

In 2026, with digital tools more advanced, AI-powered budgeting apps can automate this—saving time and highlighting savings opportunities.

Top Strategies of How to Reduce Credit Card Debt Fast USA 2026

Here are the most effective methods, ranked by speed and suitability.

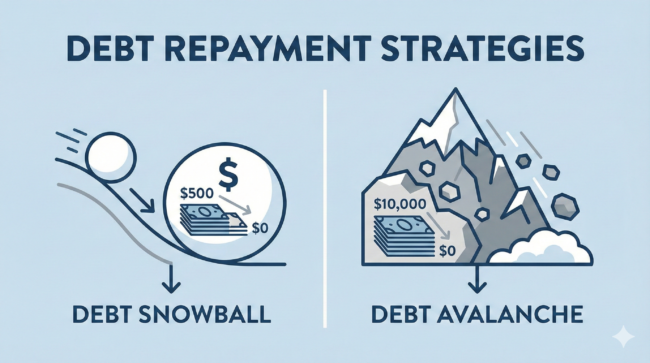

1. Debt Avalanche Method – Best for Saving on Interest

Focus on high-interest debts first. Make minimum payments on all cards, then throw extra cash at the highest APR balance. Once paid off, roll payments to the next.

- Why It Works in 2026: With rates at 25%+ on some cards, this minimizes compounding interest.

- Pros: Saves money long-term.

- Cons: Slower initial wins if high-rate debts are large.

- Tip: Use tax refunds (average $3,000 in 2026) to accelerate.

2. Debt Snowball Method – Best for Motivation

Pay off smallest balances first, ignoring interest rates. Build momentum with quick wins.

- Why It Works: Psychological boost keeps you going, as popularized by Dave Ramsey.

- Pros: Fast progress on small debts.

- Cons: May cost more in interest.

- Tip: Combine with side hustles like Uber or freelance gigs for extra payments.

3. Balance Transfer Credit Cards – Fast Interest Relief

Transfer balances to a 0% intro APR card (12-21 months promo periods common in 2026).

- Why It Works: Pause interest, letting payments hit principal directly.

- Pros: Can save hundreds in fees.

- Cons: 3-5% transfer fee; need good credit (670+ FICO).

- Best Cards: Chase Slate Edge® or Citi Simplicity® (check current offers).

- Apply Now: Balance Transfer Cards (Affiliate Link)

4. Debt Consolidation Loans – Simplify Payments

Combine debts into one lower-rate personal loan (rates 7-15% in 2026 for good credit).

- Why It Works: Fixed payments, potentially lower APR.

- Pros: One bill; builds credit with on-time payments.

- Cons: Requires approval; closing cards might hurt score temporarily.

- Tip: Shop via LendingTree or SoFi.

5. Negotiate with Creditors – Lower Rates Directly

Call your issuer and ask for a reduced APR, especially if you’ve been a good customer.

- Why It Works: Many succeed—drops of 5%+ possible.

- Pros: No new accounts needed.

- Cons: Not guaranteed.

- Tip: Mention hardship or competing offers.

6. Enroll in a Debt Management Plan (DMP)

Through non-profit credit counseling (e.g., NFCC agencies), negotiate lower rates (single-digit APRs).

- Why It Works: Professional help; rates often cut to 8-10%.

- Pros: Structured plan; creditor concessions.

- Cons: Monthly fees ($20-50); closes accounts.

- Tip: Free consultations via Freedom Debt Relief.

7. Boost Income and Cut Expenses

- Side Hustles: Gig economy jobs (DoorDash, Etsy) can add $500+/month.

- Budget Tweaks: Cut subscriptions, dine out less—aim for 50/30/20 rule (needs/wants/savings).

- Windfalls: Use bonuses or refunds aggressively.

For extreme cases, consider debt settlement—but it’s a last resort, as it hurts credit.

Comparison Table: Debt Reduction Strategies 2026

| Strategy | Speed Rating | Best For | Potential Savings | Drawbacks |

|---|---|---|---|---|

| Debt Avalanche | High | High-Interest Debts | Maximizes interest savings | Slower motivation |

| Debt Snowball | Medium | Multiple Small Debts | Quick wins | Higher total interest |

| Balance Transfer | Very High | Good Credit Holders | Hundreds in interest | Transfer fees |

| Debt Consolidation | High | Streamlining Payments | Lower fixed rates | Loan approval needed |

| Negotiation | Medium | Loyal Customers | 3-5% APR drop | Not always successful |

| Debt Management Plan | High | Overwhelmed Borrowers | Reduced rates via pros | Fees and account closures |

FAQ: How to Reduce Credit Card Debt Fast USA 2026

What is the fastest way to pay off credit card debt in 2026?

Balance transfers to 0% APR cards offer the quickest relief by pausing interest, combined with avalanche or snowball methods.

Is debt consolidation a good idea for credit card debt?

Yes, if you qualify for lower rates—it simplifies payments and can save on interest, but compare fees.

How can I lower my credit card interest rate without switching cards?

Negotiate directly with your issuer, highlighting on-time payments or hardship. Success rates are around 50-70%.

What’s the difference between debt snowball and avalanche?

Snowball focuses on smallest balances for motivation; avalanche targets highest rates to save money.

Should I use a debt relief company in 2026?

Only if DIY methods fail—opt for accredited non-profits to avoid scams.

Disclaimer

This article provides general information and is not financial advice. Debt reduction strategies vary by individual circumstances. Consult a certified financial advisor or credit counselor before proceeding. Offers and rates change; verify with providers. We may earn commissions from affiliate links, but recommendations are unbiased. Responsible borrowing is key—avoid new debt while paying off old.

Internal Links (SEO Boost)

- Best Credit Cards for Rewards USA 2026

- Best AI Tools for Making Money Online in USA 2026

- Best High-Yield Savings Accounts USA 2026

- Top Ways to Make Money from Surveys USA 2026

- Best Ways to Build Credit Score Fast in USA 2026

- How to Make Money Online Using Bank Account

- Best Online Business Ideas USA 2026

- Best Investment Apps for Gold Silver Price Forecast 2026

External Links

- NerdWallet Debt Payoff Guide

- Experian Get Out of Debt Steps

- Consumer Financial Protection Bureau Debt Resources

Take control in 2026—implement one strategy today and watch your debt shrink!