Top Tax Saving Strategies USA 2026: Reduce Bills by $5K+ Legally (Beginner Guide – Updated January 2026)

January 2026 is the perfect time to apply the top tax saving strategies USA 2026, as filing season begins with new deductions and credits. With average USA tax bills over $10,000, these legal strategies can save $5,000+ annually. This guide covers the top tax saving strategies USA 2026, step-by-step implementation, real examples, and tools – all for USA residents with no experience. Suggested search keywords like tax saving strategies for beginners 2026 usa and how to save on taxes 2026 usa help maximize refunds legally.

Why Top Tax Saving Strategies USA 2026 Are Essential for Beginners

Taxes consume 20–30% of income in the USA – the top tax saving strategies USA 2026 use IRA contributions, deductions, and credits to reduce liabilities. Suggested search keywords like tax saving strategies for beginners 2026 usa show millions saving thousands yearly.

How to Start Top Tax Saving Strategies USA 2026 with No Experience

Begin by reviewing your finances. How to save on taxes 2026 usa includes simple tools like apps and IRS forms.

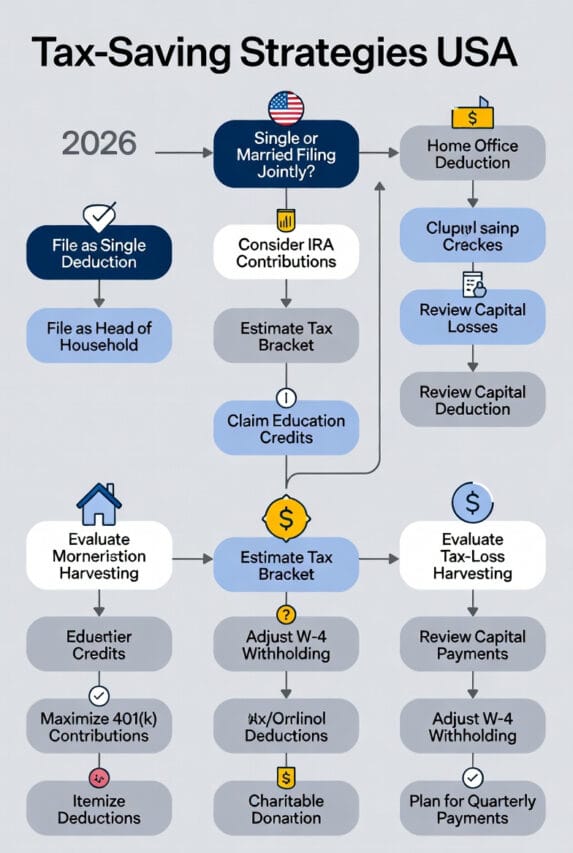

Step-by-Step Guide to Top Tax Saving Strategies for Beginners 2026 USA

- Review income/expenses and gather tax documents early.

- Maximize deductions and credits using tax software.

- Contribute to retirement accounts for immediate savings.

- Track expenses throughout the year for accurate claims.

- File early to avoid penalties and claim refunds faster.

Top 10 Top Tax Saving Strategies USA 2026 for Maximum Savings

These best tax deductions usa 2026 offer legal ways to minimize bills.

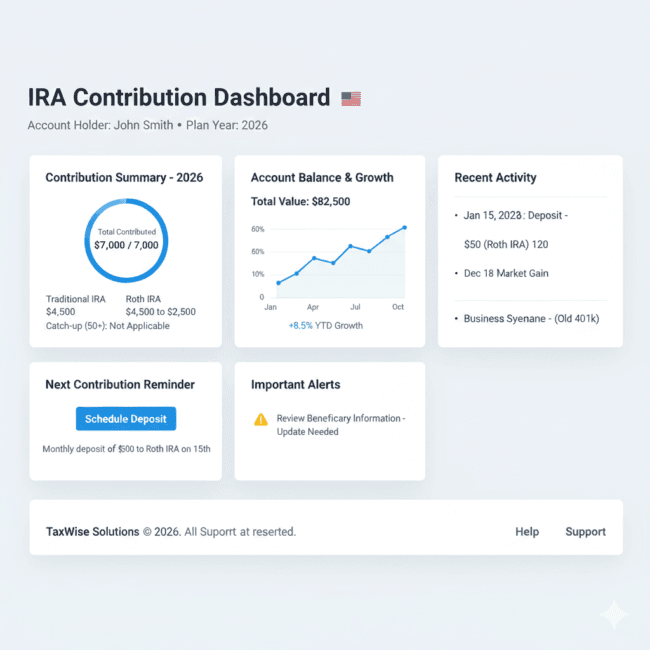

1. Retirement Contributions – Top Tax Saving Strategy USA 2026 for Beginners

- Contribute up to $7,000/year to IRA or $23,000 to 401(k) for immediate tax reduction.

- Roth IRA offers tax-free growth and withdrawals in retirement.

- Traditional 401(k) lowers taxable income this year.

- Employer match doubles your contribution in many cases.

- Real example: $7,000 IRA contribution saves $1,540 in taxes (22% bracket).

- Suggested search keywords best tax deductions usa 2026.

2. Home Office Deduction – Work-from-Home Top Tax Saving Strategy USA 2026

- Claim $5 per square foot (up to 300 sq ft) for home office space.

- Deduct utilities, internet, and repairs proportional to workspace.

- Simplified method avoids complex record-keeping.

- Best for remote workers and freelancers.

- Real example: 200 sq ft home office saves $1,000 annually.

- Suggested search keywords how to save on taxes 2026 usa.

3. Charitable Donations – Easy Top Tax Saving Strategy USA 2026

- Deduct cash donations up to 60% of AGI to qualified charities.

- Non-cash donations (clothes, stocks) offer additional savings.

- Keep receipts and use donor-advised funds for convenience.

- Best for generous individuals.

- Real example: $5,000 donation saves $1,100 in taxes (22% bracket).

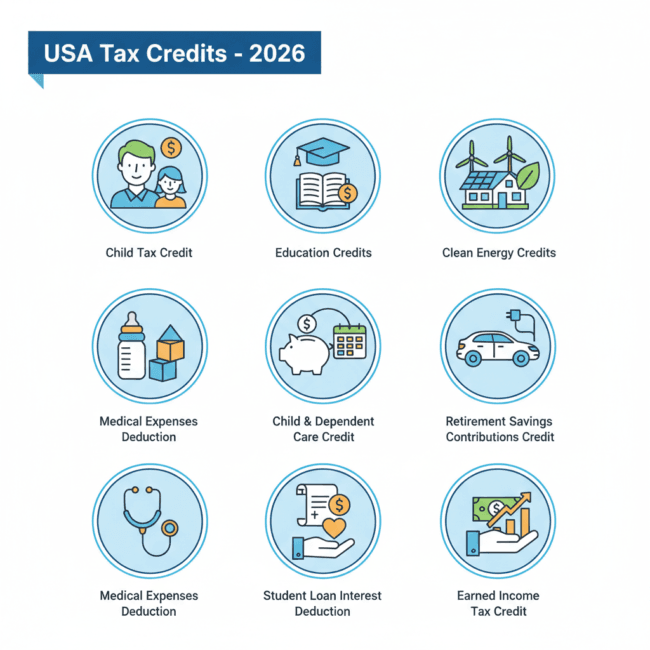

4. Education Credits – Student Top Tax Saving Strategy USA 2026

- Claim American Opportunity Credit up to $2,500 for eligible students.

- Lifetime Learning Credit offers up to $2,000 for courses.

- Deduct student loan interest up to $2,500.

- Best for families with college expenses.

- Real example: $2,500 credit reduces tax bill by $2,500.

5. Medical Expenses – Health Top Tax Saving Strategy USA 2026

- Deduct medical costs exceeding 7.5% of AGI.

- Include premiums, prescriptions, and doctor visits.

- Use HSA contributions for tax-free medical spending.

- Best for high medical expense families.

- Real example: $15,000 expenses save $2,000+ in taxes.

6. Energy Credits – Green Top Tax Saving Strategy USA 2026

- Claim 30% credit for solar panels and energy-efficient upgrades.

- EV tax credit up to $7,500 for qualifying vehicles.

- Home energy audits qualify for additional credits.

- Best for eco-conscious homeowners.

- Real example: $20,000 solar installation saves $6,000 in taxes.

7. Business Expenses – Freelancer Top Tax Saving Strategy USA 2026

- Deduct home office, marketing, software, and mileage.

- Self-employed health insurance deduction available.

- Track expenses with apps like QuickBooks.

- Best for freelancers and side hustlers.

- Real example: $8,000 expenses save $1,760 in taxes (22% bracket).

8. Child Tax Credit – Family Top Tax Saving Strategy USA 2026

- Claim $2,000 per qualifying child under 17.

- Additional $500 for other dependents.

- Phase-out begins at higher incomes.

- Best for families with children.

- Real example: 2 children save $4,000 in taxes.

9. Capital Losses – Investment Top Tax Saving Strategy USA 2026

- Offset capital gains with losses up to $3,000/year.

- Carry forward excess losses to future years.

- Harvest losses at year-end.

- Best for investors with stock losses.

- Real example: $5,000 loss saves $1,100 in taxes.

10. State Tax Strategies – Local Top Tax Saving Strategy USA 2026

- Move to no-income-tax states like Florida or Texas.

- Deduct state and local taxes (SALT) up to $10,000.

- Use retirement state tax breaks.

- Best for high earners.

- Real example: Move saves $5,000+ in state taxes.

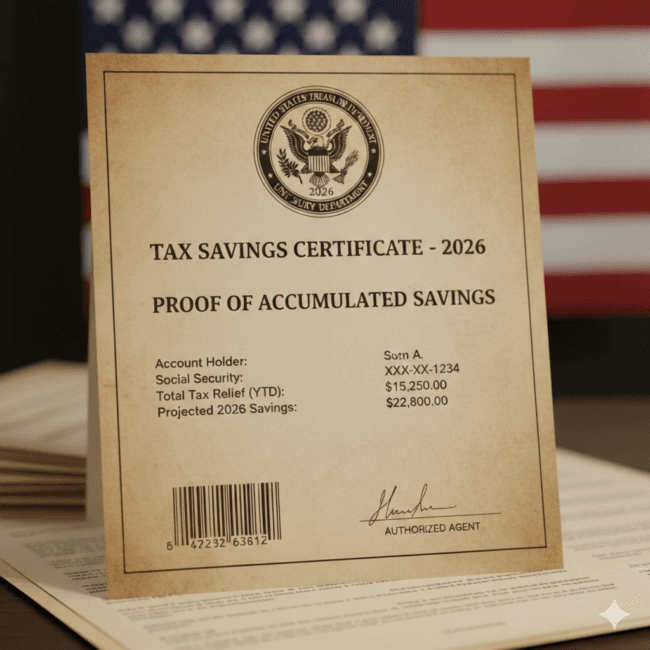

Real Savings Examples from Top Tax Saving Strategies USA 2026 (January 2026 Proofs)

Family saved $6,500 with credits; freelancer $4,000 with deductions. Suggested search keywords tax saving strategies for beginners 2026 usa show similar success.

Common Mistakes in Top Tax Saving Strategies USA 2026

- Missing deadlines.

- Overlooking credits.

- Poor record-keeping.

Suggested search keywords how to save on taxes 2026 usa help avoid pitfalls.

FAQ

What are the top tax saving strategies USA 2026 for beginners?

Retirement contributions and deductions are the easiest.

How to save on taxes 2026 USA with no income?

Use credits like EITC and child tax credit.

What are the best tax deductions USA 2026?

Medical, education, business expenses, and home office.

Can tax saving strategies for beginners 2026 USA reduce bills by $5K?

Yes, with proper planning and documentation.

How to use top tax saving strategies USA 2026 legally?

Follow IRS guidelines and use tax software.

Disclaimer

This is not tax advice. Consult a professional. Tax laws change; past savings don’t guarantee future results. Always do your own research.

Internal Links (SEO Boost)

← Best Investment Apps USA 2026 (18th Blog Post)

← Best Passive Income Ideas 2026 (17th Blog Post)

← Best Crypto Investments USA 2026 (16th Blog Post)

← Gold Price Forecast 2026 USA (11th Web Story)

External Links (Trusted Resources)

- IRS.gov (Tax info)

- TurboTax.com (Software)

- NerdWallet.com (Comparisons)

- Investopedia.com (Guides)

Final CTA

Implement top tax saving strategies USA 2026 today → Get TurboTax free via link and save on filing

→ Get TurboTax Free (Affiliate Link)

Affiliate Disclosure

This post contains affiliate links. We may earn a commission at no extra cost to you.